Thursday, March 3, 2016

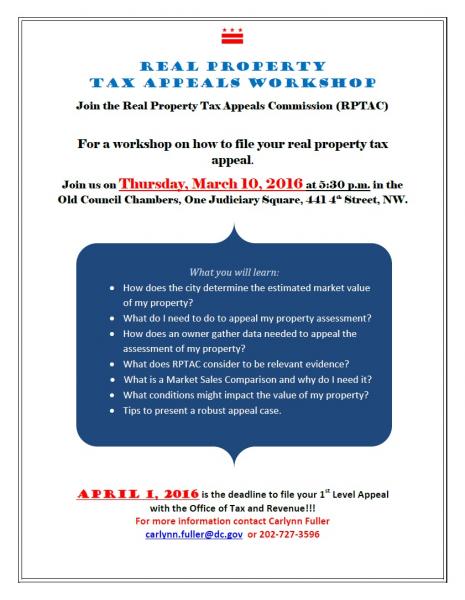

Join the Real Property Tax Appeals Commission (RPTAC) for a workshop on how to file your real property tax appeal.

Join us on Thursday, March 10, 2016 at 5:30 pm in the Old Council Chambers, One Judiciary Square, 441 4th Street, NW.

What you will learn:

- How does the city determine the estimated market value of my property?

- What do I need to do to appeal my property assessment?

- How does an owner gather data needed to appeal the assessment of my property?

- What does RPTAC consider to be relevant evidence?

- What is a Market Sales Comparison and why do I need it?

- What conditions might impact the value of my property?

- Tips to present a robust appeal case.

April 1, 2016 is the deadline to file your 1st Level Appeal with the Office of Tax and Revenue!

For more information contact Carlynn Fuller [email protected] or (202) 727-3596.